Magic Tax has been designed and developed exclusively for users of Keyloop Drive & Autoline software (previously known as Kerridge & CDK).

Registering for a Magic Tax licence to file your VAT returns digitally is quick and easy!

Since HMRC’s Making Tax Digital legislation was launched in 2019, companies have needed to either upgrade or replace their existing software, move to a compatible solution or utilise bridging software.

The regulations regarding digital links, digital record-keeping and the use of the copy/paste method to compile your data were tightened in April 2021. This has left companies who run their business using industry specific-software packages (such as those in the automotive industry) frustrated – as the software is not compatible with Making Tax Digital (VAT).

A Bridging Software solution is an option, however many of these solutions still require the data to be in a certain format and users have to manually manipulate data, copy & paste data or set up formulas and links before they can make their submission which is time-consuming and error-prone and not compliant with HMRC’s regulations regarding digital record-keeping.

We have worked closely with Keyloop users to come up with a bridging software solution that ticks all the boxes.

Making Tax Digital - Made Easy!

Magic Tax is a bridging software solution, designed and developed exclusively for users of the Keyloop (CDK, Kerridge) Drive & Autoline DMS solutions.

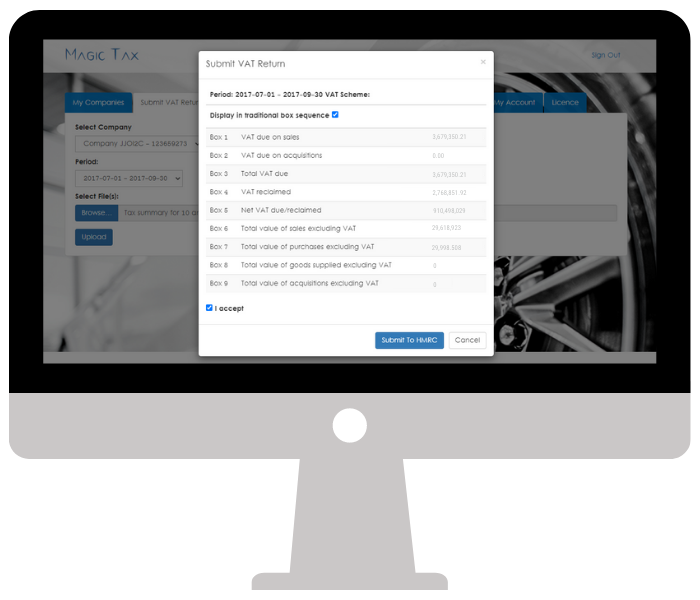

The solution ingests the data extracted from the Drive or Autoline system in the exact format it is extracted, calculates the vat values and enables users to submit their vat returns with ease. It also allows users to merge multiple VAT Summary extract files from multiple Keyloop instances into one VAT return. There is no requirement for manual manipulation or manual input, which reduces time and eliminates errors.

Get in touch

Interested in Magic Tax?

Get in touch with our team to arrange a demo

![]()