35th Anniversary Marks Decades of Innovative Software Development & Integration Services

In 2024, KFA Connect proudly celebrates 35 years of delivering cutting-edge software development and integration services.

In the fast-paced world of technology, longevity is a testament to success and adaptability.

Since its inception in 1989, KFA Connect (Kingfisher Associates) has grown from a small startup to a leading player in the software solutions industry, consistently exceeding customer expectations and staying ahead of technological trends.

Founding Vision

KFA Connect was founded with a clear vision – to empower businesses through the development of innovative and tailored software solutions on the AS/400 (now known as IBM i).

The company’s journey began at a time when technology was just starting to revolutionise industries, and KFA Connect was at the forefront, eager to embrace the opportunities that lay ahead.

Evolution of Services

Over the past three and a half decades, KFA Connect’s services have evolved to meet the ever-changing needs of businesses across various Business to Business and Business to Consumer sectors, including manufacturing, finance, telecoms, and distribution, as well as multi-channel, eCommerce and bricks & mortar trade counters / retail stores.

Initially focused on bespoke software development, we quickly recognised the importance of IBM i integration and IBM i modernisation in a digital landscape.

As technology ecosystems became more complex, KFA Connect have expanded our services to offer additional integration solutions, including courier integration and eCommerce integration. We also offer business process automation as well as our own Sales Order Processing, and Warehouse Management Solution.

Key Achievements

KFA Connect’s success is marked by a series of notable achievements, not least longevity and experience.

Thriving for 35 years in a fast-paced and ever-changing industry like IT requires adaptability and resilience. KFA Connect’s ability to navigate challenges and evolve with the times is a noteworthy achievement in itself.

KFA’s portfolio includes successful projects in verticals including finance, manufacturing, retail, telecoms, distribution and multi-channel sales including eCommerce.

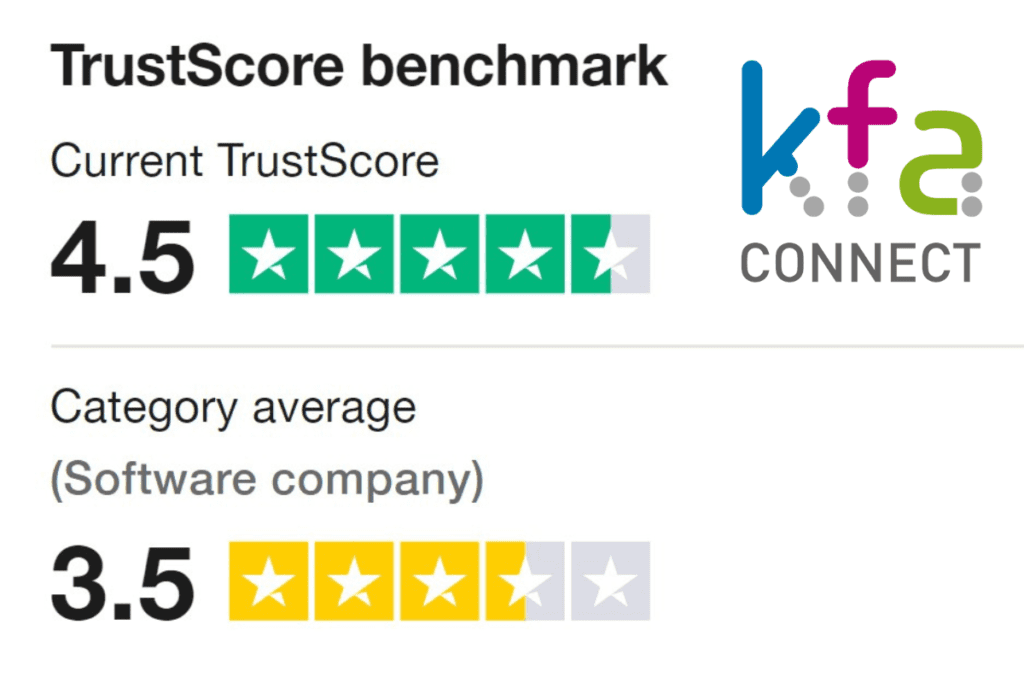

We have consistently delivered software solutions that enhance efficiency, streamline operations, and drive growth for our customers. Our commitment to quality and innovation has earned the KFA Connect team recognition as a trusted partner in the industry.

Our focus on project delivery is backed up with first class support services keeping your systems running smoothly allowing you to focus on driving new business.

The long tenure of employees highlights KFA’s commitment to fostering a supportive and rewarding work environment, where employees are motivated to stay and contribute to the company’s success.

In 2024, we will celebrate Operations Director Juliet Ward‘s 25th year with KFA Connect. Additionally, this year, Hilary Palmer will reach her 30th anniversary as a highly-valued member of the KFA development and test support team.

Our ability to understand the unique challenges of each industry and deliver tailor-made solutions, we believe has set us apart in the competitive software development landscape.

Customer-Centric Approach

One of the cornerstones of KFA Connect’s success is our unwavering commitment to our customers.

We have always prioritised understanding the specific needs and goals of our customers, ensuring that every solution is not just a piece of software but a strategic tool that contributes to their success.

To achieve this, KFA Connect has fostered a culture of collaboration and open communication.

Our dedicated team work closely with customers throughout the requirements-gathering, development, integration, and ultimately the implementation process, fostering long-lasting partnerships built on trust and mutual success.

Technological Expertise

Staying relevant in the fast-evolving tech industry requires constant innovation and expertise. KFA Connect has consistently invested in our team, ensuring they are well-versed in the latest technologies and industry best practices.

From traditional software development languages to the latest advancements in artificial intelligence and machine learning, KFA Connect’s technical prowess is a key asset that benefits our customers.

Looking to the Future

As KFA Connect celebrates 35 years of success in 2024, the company looks ahead with optimism and determination.

The rapidly evolving technological landscape presents new challenges and opportunities. KFA Connect is well-positioned to continue our legacy of delivering innovative, customer-centric solutions, not just on the IBM i, but on various other platforms.

KFA Connect’s 35th anniversary is a milestone that reflects the company’s impressive history which we are very proud of, and our ongoing commitment to excellence.

With a legacy of successful projects, a customer-centric approach, and a team of dedicated professionals, KFA Connect is poised for a future filled with continued growth and technological innovation.

Cheers to 35 years of shaping the digital future!

Would like to find out more about how KFA Connect can assist with your next IT project?